Growth stocks are companies that are expected to grow faster than others. High growth usually means more valuable. But during a recession, growth stocks generally go down as well because of the entire economy slowing down. This makes them interesting for value investors who look for undervalued stocks.

Growth Stocks Performance Since Last Year

In the chart above, we can see in yellow the performance of the Vanguard Value Index Fund vs the performance of the Vanguard Growth Index Fund in blue. On this day, the growth index fund is down 15.45% compared to the value index funds which is down 1.70%. This means a couple of things.

First, the value fund is less volatile than the growth fund. Generally, value stocks are less volatile than growth stocks because investors tend to favor the buy and hold strategy with them. Also, value stocks tend to be less affected by recessions because they often have strong fundamentals which makes them less risky to hold than stocks with high debt and no cash.

Second, the growth fund is probably closer to its intrinsic value now than was a year ago. There are great businesses that are considered growth stocks and are part of growth funds and ETFs that are safer to invest in than the majority of the other stocks in the fund. Tech stocks for instance. Tech stocks have high margins and low debt which makes them less risky, providing their price is fair.

Third, the fall of the growth fund also indicates that the underlying assets were overbought and overpriced. In Why ETFs Are Overpriced, I explain why index funds and ETFs hold overvalued stocks and how the popularity of these funds further accentuate the overvaluation. This is backed by 4 papers which are referred to in the article.

Fourth, there is an opportunity for individual stock picking right now. The inefficiencies of index funds and ETFs proves that great stocks can be mispriced because of the price fluctuation of the ETFs affected by the price of the underlying assets.

Taking A Look At 2 Opportunities

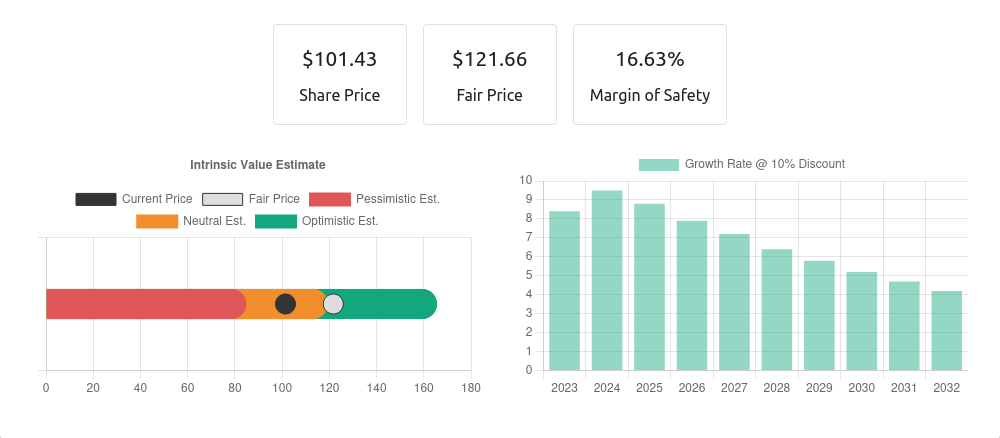

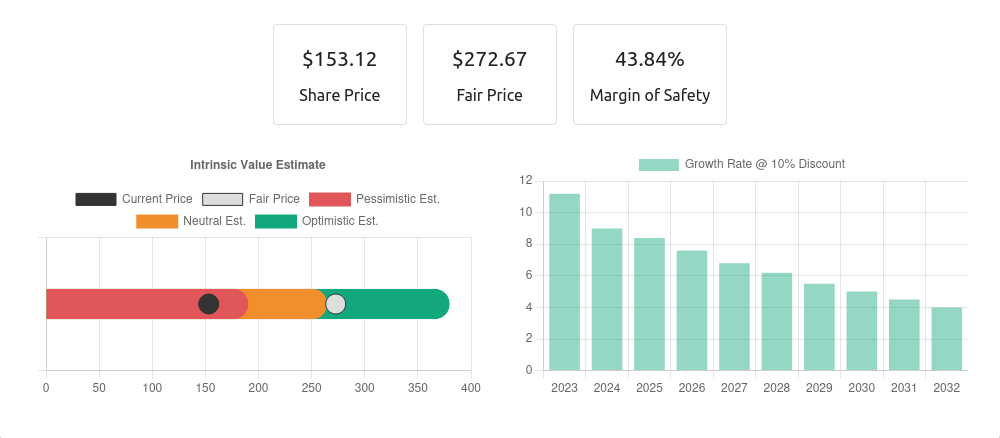

Tech stocks are known for being high-growth stocks and can be great investments, especially during a recession or even in today's market conditions. Here are two examples of great businesses at a fair price:

Alphabet generates revenue through ads generated by Google Search. Alphabet also generates revenue through its other products, such as YouTube, Gmail, and Google Cloud. These products also offer paid services, such as premium YouTube memberships and storage upgrades for Google Drive, which bring in additional revenue for Alphabet. Overall, the company's main source of income is advertising, but it also earns money from its diverse range of products and services. They have the monopoly over search engines but that could change with the arrival of ChatGPT and Microsoft's $10 Billion investment in the technology.

Meta might be a better buying opportunity if you believe in the whole meta-verse promise. It is still generating revenues through advertising, offering premium services for a fee, partnering with other companies, and selling data and analytics. With its mix of advertising, premium services, and data, Meta still provides value to individual users and businesses.

Conclusion

As we arguably enter a recession, it is important to remember that stocks that are falling quickly might actually present nice investment opportunities. Make sure to watch the tech and energy sectors.