Exchange-traded funds (ETFs) allows investors to buy shares in a bundle of stocks. They can track the performance of a specific index, such as the S&P 500, companies operating in a particular sector or even reflect certain investment strategies.

ETFs may hold over-priced stocks because indices such as the S&P 500 are constructed based on market capitalization. This means that the largest companies make up a larger portion of the index. However, market capitalization does not reflect a company's intrinsic value and many companies may be overvalued when included in an index. ETFs managers are not actively buying and selling stocks based on the fundamentals of the companies. The same principle also applies to ETFs concentrated on a particular sector like EVs, energy, innovation, etc. The underlying assets are chosen based on different criteria than their fundamentals and you might end up with companies that you would never buy individually.

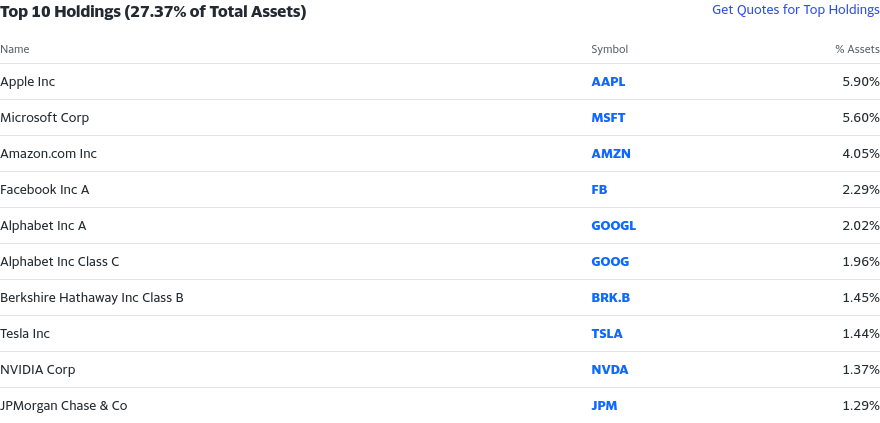

Let's take a look at the top 10 holdings of SPY, an ETF that tracks the S&P 500:

All these companies are currently overvalued (at the time of writing) according to ValueStocks except for Apple, Alphabet and Meta. Fortunately, their allocation represents 12.5% of the entire index. But not long ago, before growth stocks started to decline, they were seriously overvalued. Now, my point is that, in an ETF, you have no control over the stocks that you pick. This is probably the best thing that passive investors looking for peace of mind should do, but not someone who wants to optimize his returns.

ETFs Holdings Are Mispriced

According to these 4 papers, the authors found that higher stock price changes in the ETF happens regardless of factors related to the stock itself. They also found that when a stock is included in an ETF, it becomes more similar to other stocks in that ETF. As more people invest in ETFs, this trend could continue. This means that there could be an opportunity for stock pickers because prices can become artificially inflated and leading to further accentuation of the overvaluation of popular stocks and undervaluation of others.

As John Duffy states in The Impact of ETF Index Inclusion on Stock Prices,

We find that inclusion of an asset in the ETF index results in a substantial price premium. This is due to investors' strong demand for the ETF asset and use of a buy-and-hold strategy that reduces the tradeable supply of the assets that underlie the ETF asset and increases their price. Short-selling helps to alleviate the supply problem, but given the strong demand for the ETF asset, the inclusion premium persists.

In other words, when an asset is put into an ETF index, its price goes up because more people want to buy it and keep it for a long time. This reduces the number of the underlying assets available to buy and makes their price go up too.

In The effect of ETFs on financial markets, Luca Liebi states,

[...] by decomposing the information efficiency gain from the non-fundamental effect of ETFs the authors find that increasing volatilities in the security basket are the result of non-fundamental information. Finally, the academic literature finds that following the inclusion of a stock in an index, its correlation with other stocks included in the index increases. The continuous growth of passive investments in general and ETFs in particular, may reinforce this mechanism.

In other words, when an ETF is bought or sold, it affects the price of all its underlying assets regardless of their fundamentals, price or market conditions. This means that there is a correlation between the price of an ETF and all its underlying assets.

According to Passive Investing and the Rise of Mega-Firms,

Flows into passive funds raise disproportionately the prices of the largest stocks in the index, while also making them more volatile. If, in addition, stocks are mispriced because of noise traders, then passive flows raise the most the prices of the overvalued stocks among the index’s largest.

When people invest in passive funds, the prices of the biggest stocks in the index go up a lot and become more volatile. If these stocks are already overpriced due to other factors, the prices of these overpriced stocks will go up even more. This further accentuates my point about large market capitalization stocks making up a larger portion of an index or ETF. This means that large cap stocks could be mispriced and overvalued, giving more opportunity to find interesting small to medium cap stocks.

In Do ETFs Increase Stock Volatility?,

[...] much of the variation they study in ETF ownership of stocks is arguably independent of the inherent volatility of the stocks, the authors conclude that rising ETF ownership affects volatility.

They studied ETF ownership of stocks changes and found that it does not depend on the natural change in the stock's price. They concluded that as ETF ownership goes up, the stock's price becomes more unstable.

Conclusion

While ETFs are great for the average passive investor, they have risen in popularity. This means that there is an opportunity for stock pickers that are looking at mispriced stocks. Particularly in stocks that are less traded or less included in an ETF or index. Whether you do your own research or that you use ValueStocks, these opportunities should not be underestimated.